Top Guidelines Of Good House Plans

Wiki Article

More About Good House Plans

Table of ContentsExamine This Report about Good House PlansIndicators on Good House Plans You Need To KnowThe Ultimate Guide To Good House PlansThe Ultimate Guide To Good House Plans

Residence insurance policy may also cover clinical costs for injuries that individuals received by being on your building. When something is harmed by a disaster that is covered under the house insurance plan, a property owner will call their residence insurance coverage firm to submit an insurance claim.Homeowners will usually have to pay an insurance deductible, a fixed amount of cash that comes out of the homeowner's pocketbook before the residence insurance provider pays any kind of money towards the insurance claim. A house insurance deductible can be anywhere in between $100 to $2,000. Generally, the greater the deductible, the lower the annual premium price.

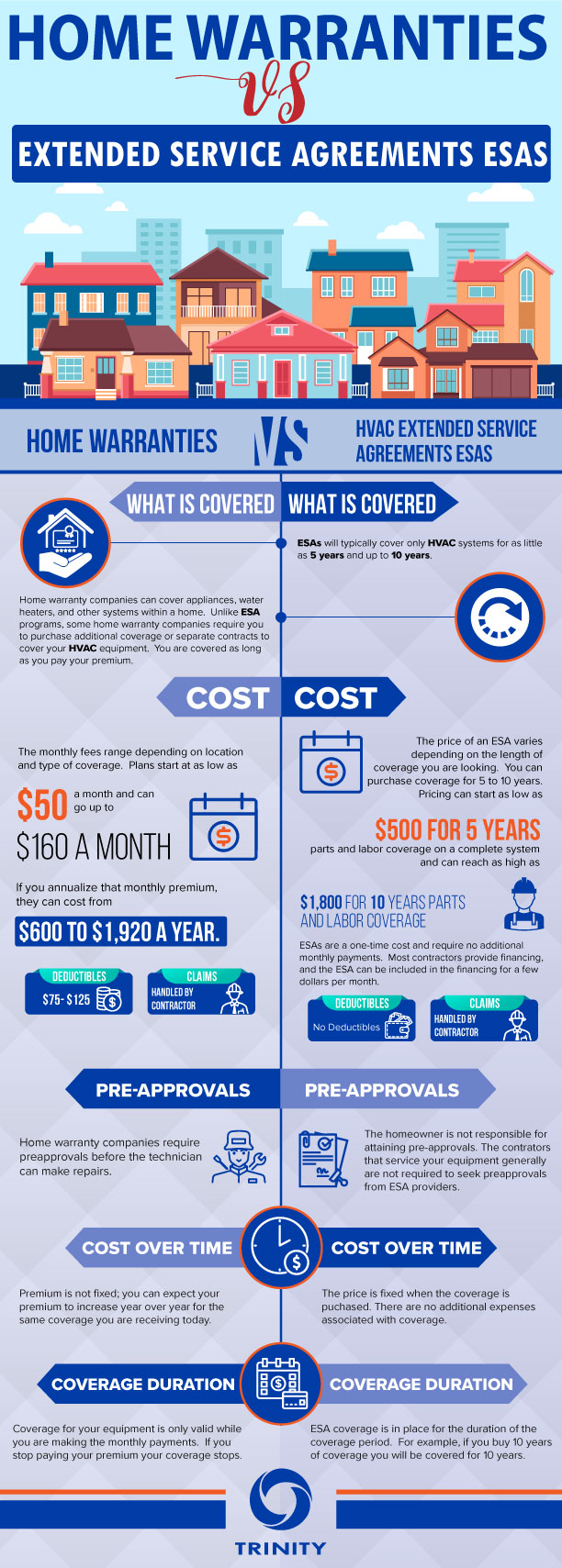

What is the Difference In Between Residence Guarantee and also House Insurance Policy A house warranty contract and also a home insurance coverage policy operate in comparable means. Both have an annual costs and an insurance deductible, although a home insurance coverage costs and deductible is often much more than a house service warranty's. The main differences in between home guarantees and also home insurance coverage are what they cover.

An additional difference between a home guarantee as well as house insurance coverage is that house insurance coverage is generally required for property owners (if they have a home loan on their house) while a house guarantee strategy is not needed. A house guarantee and house insurance coverage offer security on different parts of a home, and with each other they can protect a property owner's budget from expensive repairs when they inevitably emerge.

Good House Plans Things To Know Before You Get This

If there is damages done to the structure of your house, the proprietor won't need to pay the high expenses to repair it if they have residence insurance. If the damages to the home's framework or house owner's belongings was produced by a malfunctioning home appliances or systems, a home service warranty can assist to cover the pricey repair services or substitute if the system or home appliance has actually stopped working from normal wear as well as tear.They will interact to offer defense on every part of your residence. If you have an interest in buying a home guarantee for your house, have a look at Spots's home guarantee plans and also pricing right here, or demand a quote for your residence right here.

The difference is that a residence warranty covers a variety of items as opposed to just one. There are 3 basic kinds of home guarantee strategies. System plans cover your house's mechanical systems, including heating and cooling, electric and plumbing. Device plans cover major devices, like the dishwasher, stove and also washing equipment.

Good House Plans - The Facts

Some things, like in-ground lawn sprinklers, pool and also septic tanks, might call for an added service warranty or could not be covered by all house service warranty business. When contrasting house guarantee business, make sure the plan choices include every little thing you 'd want covered.New building houses commonly included a guarantee from the contractor.Contractor warranties generally do not cover appliances, though in a brand-new home with brand name brand-new home appliances, manufacturers' warranties are most likely still in play. If you're getting a residence service warranty for a brand-new home either brand-new building and construction or a house that's new to you insurance coverage normally starts when you close.

Simply put, if you're acquiring a house and a concern turns up during the residence assessment or is noted in the vendor's disclosures, your residence warranty firm might not cover it. Instead of counting entirely on a warranty, attempt to negotiate with the vendor to either correct the issue or offer you a credit rating to aid cover the expense of having it dealt with.

You don't need to study and also get suggestions to locate a tradesperson each time you require something fixed. The other hand of that is that you'll obtain YOURURL.com whomever the residence warranty business sends out to do the evaluation and make the repair service. You can not choose a professional (or do the job on your own) and afterwards get repaid.

5 Simple Techniques For Good House Plans

house insurance policy, A residence service warranty is not the like home owners insurance. For one, house owners insurance coverage is needed by loan providers in order to acquire a mortgage, while a home warranty is totally optional. Yet the bigger differences are in what they cover as well as how they work. As mentioned over, a house service warranty covers the fixing as well as substitute of items and systems in explanation your residence. good house plans.Your homeowners insurance policy, on the other hand, covers the unanticipated. It won't assist you change your home appliances due to the fact that they got old, however home owners insurance policy might help you obtain brand-new home appliances if your existing ones are harmed in a fire or flood.

:max_bytes(150000):strip_icc()/best-home-warranties-4777763_color-84f2d9cd3a924002ac1205fd676e3f1c.png)

, you will pay a solution charge every time a tradesperson comes to your residence to assess a concern. This charge can range from regarding $60 to $125 for each service instance, making the service charge another point to consider if you're shopping for a residence warranty strategy (good house plans).

Report this wiki page